Once an organization decides to run an environmental project or programme, it should assess the economic consequence of this programme. Thus the advantages (benefits) are compared to the disadvantages (costs) to assess how desirable the project is.

Traditionally, while organizations are used to financial assessments and report to their shareholders, they must now also assess their environments and give the information obtained from this Cost benefit analysis (CBA) to their stakeholders. Thus the CBA has a vital role to play in environmental programmes.

CBA is defined as a broader project appraisal tool which provides a framework for measuring the economic costs and benefits of project on society (the stakeholder community) as a whole, including environmental effects, irrespective of whether they are captured in an investor’s financial accounts.

Project appraisal can range anywhere between two extremes; from simple financial appraisal to complex full- scale social cost benefit appraisal. The choice of type of appraisal would depend on the investor’s objective.

If the objective was to maximize shareholder value then financial appraisal was the route. However an investor interested in addressing the concerns of all relevant stakeholders including environmental concerns then CBA is the route to go.

Methodology of CBA

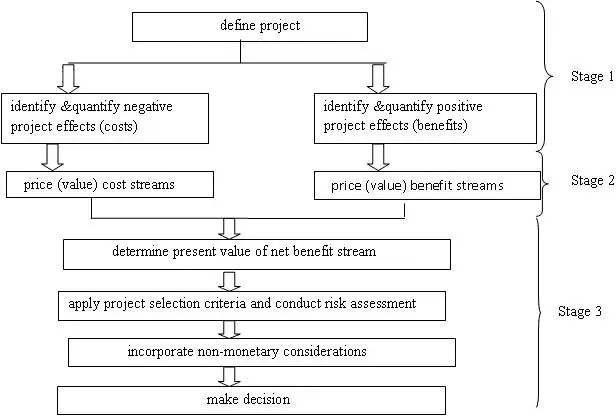

CBA approach may be divided into three main activities or stages.

Identification of all parties affected by the project and quantifying of the impacts of the project on these parties.

Attaching an appropriate price tag to all economically relevant impacts

Read Also : Types and Costs of Environmental Audits

Discounting of all costs and benefits that occur in different time periods to determine the net benefit and make a decision on the relative economic project benefit.

Cost benefit Analysis Framework

Identify and quantify project effects

Costs are usually divided into;

Capital or investment costs which are costs incurred at the setup of the project and may be referred to as non-recurrent expenditure. This includes costs of land and property, infrastructure and equipment costs as well as installation costs.

Recurrent costs are those costs due to operation and maintenance and include energy costs, labour costs, material costs.

External or third party costs these may be the ascribed as a result of activities which adversely affect third parties such as water pollution by industry causing illness and all the costs associated with the illness.

Benefits may be:

Direct revenue earned from the project’s output

Cost savings as a result of the project

Forgone or avoided external costs must also be included in a

Project’s benefit streams.

In identifying ascribed costs or benefits the base situation is always used as a comparison since it is defined as the ‘do nothing’ case.

Value costs and Benefits

While tangible costs and benefits can be valued using market prices, environmental commodities do not have market prices but must be valued none the less.

A range of valuation techniques have been developed and which attempt to measure either willingness- to- pay (for improvement in environmental quality) or willingness- to- accept (compensation for reduction in environmental quality). The techniques used to assess this fall into three groups.

Techniques using actual market prices

It is possible to value costs and benefits which can be priced whether the project effects can be seen or not. It uses the same valuation method as normal financial accounting methods used include

Change in productivity – here a change in the environment results in a change in the ability to produce a commodity or increase the cost of producing it. An example is air pollution causing reduced farm production.

The change in usual production can be evaluated. A dose response method is used such that you can predict the change in output per unit change in environmental quality.

Preventive expenditure/Replacement Cost Approaches: Replacement cost approach uses the cost of repairing or replacing an asset affected by the environmental change as an estimate of the benefit of eliminating the negative environmental change.

Preventive expenditure approach uses the expenditures as an estimate of the benefit of eliminating the negative environmental change.

Surrogate Market Approaches

The value of substitute goods in surrogate markets are used to value environmental goods and services. Surrogate market approaches include

Property value approach- using price differentials between houses with different attributes including environmental attributes, the implicit values of the environmental attributes are determined and changes in the attributes can then be valued.

Wage differential approach-Similar jobs in locations with different environmental conditions are valued, assuming that you need higher wages where increased level of pollution and greater risks to life and health exist. The changes in wage rates are used to determine the effect of the environmental changes.

Travel cost approach- The value placed on a recreational activity is inferred from demand. These values are used to monetize changes in quality and /or quality of the recreational activity and its environmental components.

Survey Based Approaches

Where the market valuation methods- surrogate market techniques and market price techniques cannot be used, methods based on responses to surveys are used. Methods include

Contingent valuation Method- Personal valuations of respondents’ willingness to pay or willingness to accept compensation. The valuations are for changes in quality or quantity based on hypothetical and not real situations.

Contingent rating – Choices are ranked on hypothetical situations on different goods including environmental attributes

Decision Making

Once the inputs and outputs are priced you need to make a decision. This involves comparing costs and benefits and applying a decision rule.

However projects tend to run for a period of time, costs incurred today must be compared with benefits accruing in the future.

Thus weighting to allow comparison for different points in time occurs to calculate the present value of the costs and benefits. This process is called discounting.

The criteria for ‘discounted’ project are

Net present value (NPV) method – This is the present value of estimated benefits net of costs. A project is accepted if the present value is greater than zero. A positive NPV means benefits outweigh costs and a negative NPV means that costs outweigh benefits.

Benefit- cost ratio method- This is the ratio of sum of the discounted net benefits (benefits-costs) to the discounted investment costs i.e. B/C. A project is accepted if B/C ratio is greater than 1. This implies that NPV is positive.

Internal Rate of Return (IRR) method- The internal rate of return is rate of discount at which discounted net benefits equal discounted investment costs. At this discount rate selected IRR rate the NPV is equal to zero. A project is acceptable if it’s IRR is greater than the discount rate selected thus NPV is positive.

In addition to these 3 methods the non-monetary or unquantifiable effects are itemized and quantified as much as possible and determine to what extent they would affect the already determined NPV negatively or positively.

The Use of CBA in EMS

In attaining the environmental objectives and targets set by an EMS in line with the environmental policy of an organization, resources will need to committed. To ensure efficient use of these resources an appraisal of its costs and benefits will need to be undertaken i.e. a CBA.

Moreover if environmental effects are to be compared with tangible goods and services the means of comparing them in equivalent monetary units is the CBA.

In conclusion,CBA has an important role to play in determining the effects environmental projects or programmes. Its basic principles are in economics and accounting and by determining net costs to benefits a decision is made as to whether a programme or project should continue or not.

CBA is as a broader project appraisal tool which provides a framework for measuring the economic costs and benefits of project on society as a whole, including environmental effects, irrespective of whether they are captured in an investor’s financial accounts.

CBA approach may be divided into three main stages which are identification of all parties affected by the project and quantifying of the, attaching an appropriate price tag to all economically relevant impacts, discounting of all costs and benefits that occur in different time periods to determine the net benefit and make a decision on the relative economic project benefit.

Read Also : Waste Recycling and Disposal Guide

The criteria for ‘discounted’ project are Net present value (NPV) method, Benefit- cost ratio method and the Internal Rate of Return (IRR) method.

CBA ensures efficient use of these resources and enables environmental effects to be compared with tangible goods and services by comparing them in equivalent monetary units.